.Who remembers “Bank Transfer Day”? 5 November 2011. It was during the Occupy Movement that started in Zuccotti Park in NYC, and spread across the US. Protests and encampments to rise up against Wall Street, and all that corporatism had wrought.

The specific proximate cause to Bank Transfer Day was the Durbin Amendment to the Dodd-Frank Act. With good intentions, the Amendment decreased the maximum charge on individual debit card transactions. This made banks, most notably Bank of America, decide to charge debit card holders a $5 monthly fee1. A woman named Kristen Christian decided she wasn’t going to stand for this, and posted to Facebook that she was going to move her accounts from her bank to a credit union on 5 November. Source. The post went viral, and depending on whose numbers you believe, upwards of half a million people switched.

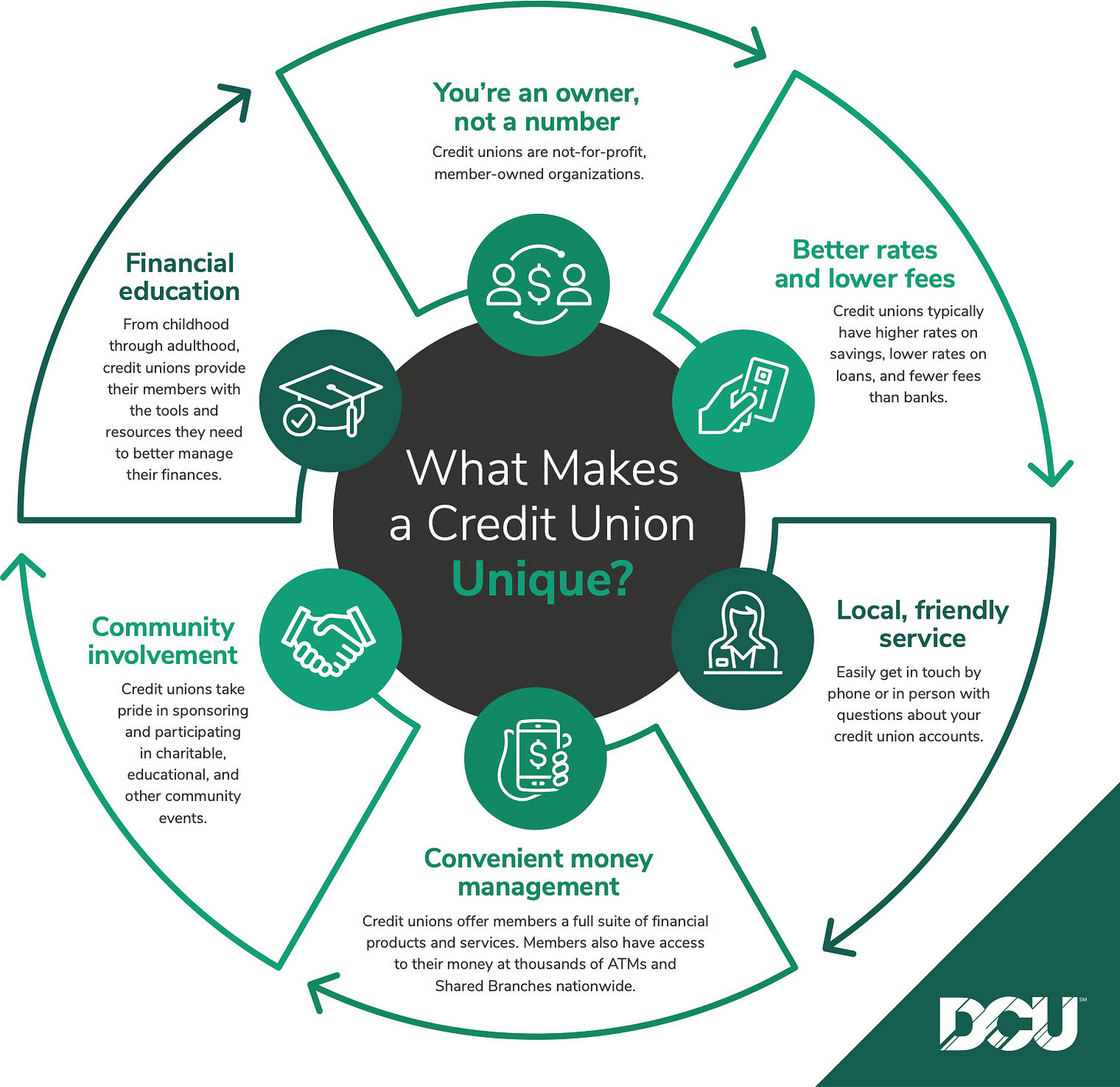

A credit union2 is a member-owned nonprofit cooperative financial institution. Note the important words “member-owned” and “non-profit”. That non-profit status makes credit unions tax exempt.

Most credit unions are small, with 1 - 5 branches, but range up in size to the US Navy Federal Credit Union, which has over 13 million members. Source.

Most importantly, credit unions are FOR their members, as opposed to a for-profit bank that leverages customers, meaning fees and the like because their goal is to make money on their customers.

One of the things the fascist regime is floating is to tax credit unions. This would be part of the budget process currently being negotiated in the House and Senate. There is no associated bill number in either chamber, it’s just talk. For now.

Taxing credit unions would destroy them, for obvious reasons, namely that “member-owned, non-profit” fundamental.

You may wonder why the fascist regime is interested in doing away with credit unions. It has to do with their desire to destroy the US monetary system and put everyone on crypto from which they can grift3. One way that they’ll do this is to merge the FDIC into the Treasury Department. This article discusses how the FDIC might change, and what it would mean for the insurance (or lack thereof) on your bank accounts. The article claims it’s not time to move your money for safety’s sake to a credit union, as the insurance is through the NCUA, which theoretically, the regime could also screw with. BUT deposit insurance only matters when banks or credit unions fail.

There’s a better chance a bank will fail than a credit union will fail. List of bank failures. List of credit union failures. Not all banks will fail, mind you, more likely big banks. Back during the great recession of 2007 - 2009, there were a number of banks that didn’t lose a single dime on a bad mortgage. These were small, old, local banks that were very careful in terms of the people to whom they lent money. Likewise, being a community-centric undertaking, credit unions tend to also be conservative in their lending policies, because they don’t want to lose their members’ money.

Credit Unions are a win-win. Both for their depositors, and their communities writ large. And yes, I know from personal experience how difficult it is to change banks, whether from one bank to another, or from a bank to a credit union. But think about WHERE you want your money, and whether you want your money to benefit your local community or to be used to increase corporate profits. It’s a values thing.

Use this link to find a credit union near you.

The time is now to use the “Contact Me” page for your Congressman/woman and your Senators to ask them to say “NO” to taxing credit unions. There is also a site from which you can send a message to your elected reps. However, PLEASE erase the boilerplate, and replace it with your personal thoughts. The reason for this (and the reason using the “Contact Me” page is better) is that elected reps respond less to mass mailings and petitions, and more to overwhelming response on an issue from constituents who take the time to write to them. Here’s the link from the credit union organization.

Often, we think “big”. We need X number of people at a protest to make the news. We need a sea change to save Medicaid. We wonder if what we do as an individual matters. Remember that Kristen Christian started the ball rolling to get a half million people to move from their banks. She is ONE PERSON.

My all time favourite quote is from Margaret Mead:

Never doubt that a small group of thoughtful, committed citizens can change the world; indeed, it's the only thing that ever has.

YOU can help make sure that WE THE PEOPLE are able to keep credit unions.

Contact your reps TODAY. And then send a follow up every two weeks to remind them that you still care about this issue.

Restack this post on Substack.

Share this post with 5 people, and ask them to contact their reps.

Taxing credit unions will be a small line item in the budget that will likely go unnoticed unless we bring it to the attention of the members in Appropriations and then to the attention of our Reps and Senators.

We can do this!

BE A LIGHT IN THE DARKNESS!

Later rescinded.

If you’re unfamiliar, most credit unions do most of what banks do, just by different names. Credit union share accounts are savings accounts, their share draft accounts are checking accounts, and their term certificates are CDs. Like banks, they offer credit cards, mortgages, and car loans.

I cannot prove this, but that’s my gut, and if you know something else, leave it in the comments.

Thank you for this. I had no idea that these clowns are considering this. It’s so obvious the orange one and his lackeys want to destroy all that is good. We love our credit union and wouldn’t think of big banking again!! I’ll spread as much of this message as possible. 💙💙💙

Hi Jessica. What is the date for your interactive election talk? Thanks.