Not only do I LIKE paying taxes, but I BELEIVE in the good that taxes can procure. I love government services. I abhor with every cell of my being the cuts that the criminals are making.

I know what you’re thinking. You think you are paying too much in Federal income taxes, and that you hate paying taxes.

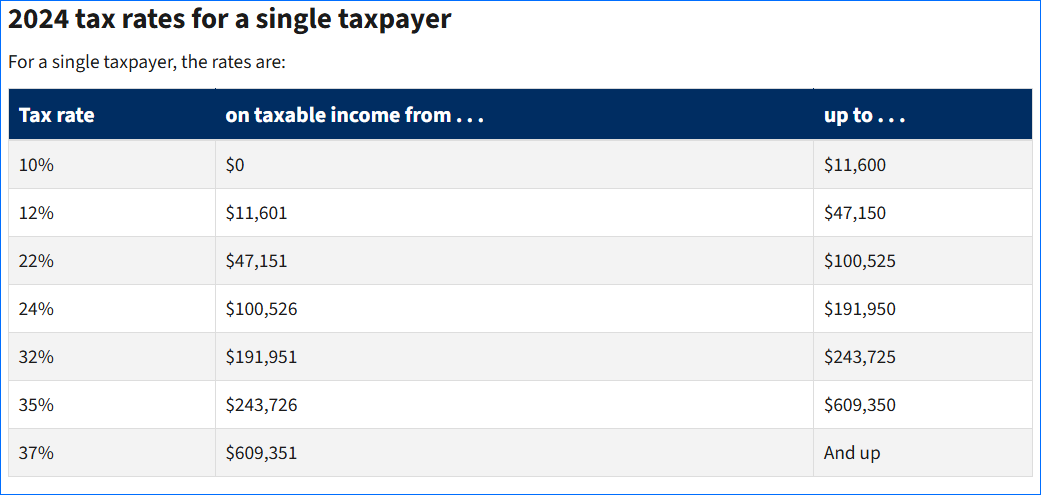

First, you pay a lot less than you think in Federal income taxes. People look at a tax table like this1, and think, WOW I pay too much of my income.

But that is NOT what you pay.

Let’s pretend you’re a single person earning $100,000/year2. You may think you pay 22% or $22,000 in taxes. Nope. First, your “income” is likely less than $100,000 if you subtract out any health insurance deducted from your pay (if you work for a large company) plus monies deposited into an IRA or a 401(k), maybe an HSA. So let’s take that down to $90,000. Then, you receive a standard deduction (or maybe more if you itemize). For a single person for 2024, that’s $14,600, bringing your income down to $75,400. You may also have a childcare credit, and yes, your income would be higher if you earned interest and/or dividends.

But let’s go with $75,400. That 22%? It’s a MARGINAL rate, not what you actually pay. So when we look at the tax table:

That’s 11.6% NOT 22%. And if you have a mortgage and are deducting interest payments, your itemized deductions will bring the rate down even further. To find out what YOU actually pay in Federal income taxes, take the value on line 16 of your 1040 form and divide it by your gross earnings.

Now that the math is over, I’m going to list the things I’m happy to pay taxes for. Some of these things come directly from Federal coffers, and some come from Federal disbursements to the state and local entities. My list is in no particular order, and is in no way comprehensive for all that tax dollars buy.

I like roads, bridges and tunnels. I like that I can drive on pavement wherever I want to go, instead of trying to get my Honda Fit over gravel and mud.

I love contributing to Medicaid, SNAP, WIC, TANF, Head Start and all the rest of the safety net3.

I value contributing to Veterans’ programs, it’s the very least any of us can do to truly thank them for their service.

I am a million-mile flyer. I appreciate that (until the fascist regime took over) it was safe to fly thanks to ATC and the rest of the FAA. Not to mention that 90% of airport construction and improvements are funded by the Federal government.

I’m big on medical research. I am alive today because the government paid for initial research into what became the cancer drug that saved my life. There’s a good chance that had I gotten the same disease a few decades earlier, it would have been a death sentence. This is true for millions of people in terms of all the research dollars spent saving lives for all sorts of conditions.

I’m a fan of the internet. NO, not all of it, but a lot of it. Why do we have the internet? Because in 1969, the Federal government paid for a research project that created ARPANET, forerunner to what we have now.

Let’s not forget the Community Development Block Grant (CDBG) program. Over the years, I’ve seen the good that CDBGs have done for, amoung others, underserved communities. Example: in college, we secured a CDBG for a local services center. The grant paid for the space, utilities, supplies, and advertising. We helped local residents apply for benefits, get into training programs, and be connected to other services.

And then there’s NEPA, the National Environmental Policy Act. Believe it or not, this was one of the best things Tricky Dick pushed for4. When I was a little kid in NYC, if I sat on the fire escape with a glass of milk, within minutes, it would have gray specks covering the top, due to air pollution. Back in the day, the Cuyahoga River went on fire more than a dozen times. NEPA, over the years, has given us better air to breathe, cleaner rivers and waterways, and other environmental improvements.

The Federal government pays a certain amount of money for education. I am a HUGE supporter of education. School buildings, related infrastructure, teachers, supplies, IEP programs, after school programs, you name it, I want my tax dollars to go for it5.

While it is a tiny part of the budget, foreign aid, especially things like USAID, PEPFAR, and support for Ukraine are near and dear to my heart.

And let’s not forget MONEY. Who do you think prints our paper money and coinage, and then stands behind it?

Then, there’s the weather. Without the National Weather Service, I’ll be reduced to John for weather forecasting.

While I have a few mixed feelings about FEMA - I support that they help people devastated by hurricanes, floods, fires, tornadoes and other natural disasters. My only qualm is that people shouldn’t rebuild in areas at high risk of facing the same problem going forward. But you see, I do NOT believe in throwing out the baby with the bath water. Keep FEMA. Make better decisions.

Before Worm Brain, I loved NIH, FDA and the CDC. Their research, their knowledge, their dissemination of information, their work with similar departments in other countries. ALL DEDICATED to eradicating disease when possible, and dealing with it when eradication is impossible. Warning us all about recalls of foods that will potentially kill us. And, until last week, determining which strains should go in this year’s flu vaccine.

While it is NOT paid for out of Federal income tax receipts, the Social Security and Medicare programs are essential, and they are paid for by the Feds, albeit out of the trust fund which is paid for by payroll taxes.

I could go on, but I think you get the idea that government matters, and face it, paying taxes is what funds government6.

The one thing I HATE about government spending is that they take OUR tax dollars and use them to underwrite the uber rich, and corporations. And in case you were wondering, corporate taxes, as a percentage of Federal revenue has fallen from about a third in the early 1950’s to well under 10% today.

People used to have no problem paying their taxes. They agreed with Oliver Wendell Holmes, who said:

Taxes are the price we pay for civilization.

Henry Ford was a big proponent of taxes. He believed that a well-educated workforce with good infrastructure was essential for a productive and efficient company, so he actively supported policies that funded public education and road development, even if it meant paying higher taxes himself. As an aside, he believed in paying fair wages, so his employees could afford his cars, and he also said:

Profits made out of the distress of the people are always much smaller than profits made out of the most lavish service of the people at the lowest prices.

I hope you now have a better appreciation of what your income taxes go for.

Yes, the rates are different for married couples and heads of household.

I picked $100,000 because it’s a round number, and the math is easy. It’s also in the “middle class” tier for much of the country. If you made a lower salary, these numbers would show that you pay a far lower percentage of your income in Federal income taxes. For example, if you were a single person who made $20,000 a year, took the standard deduction, and didn’t use a childcare credit, you’d pay at most $543 for the year.

I understand the privilege I have. While I am certainly not rich, I earn enough money that I live inside, have potable water, indoor plumbing, electricity and there’s enough food to eat. TOO MANY PEOPLE don’t have these things - so if my tax dollars feed someone, or pay for a Section 8 voucher, or help a young child learn to read….I am THRILLED to do so. I believe in the progressive tax system, and believe those who earn more, should pay more.

Another was what we now call “Medicare for All”, although he never saw that come to fruition. For all his faults, he would have loved the ACA as a start to what he envisaged.

The majority of school funding is local, with some state funds, in addition to what comes from the Feds. Other local things I’m happy my tax dollars go to include libraries, public safety, streetlights, local roads (especially pothole filling this time of year), parks and trails, and local public facilities.

…but with all those agencies gutted and programs cancelled, where’s our tax money going?

Thank you for this post. I often feel like the government is "ripping me off," but this post is a good reminder of what those taxes are used for. Thank you. (But also, I am not thrilled with being asked to pay $8,000 at tax time when it's something I don't have. Yes, you can pay in installments, but correct me if I'm wrong, I think you also pay interest.) I wish there were a better way of knowing what you would pay in advance so you can adjust your withholdings moving forward. Right now, I just keep increasing my federal withholdings, hoping it covers enough to reduce any exorbitant tax bill I get.