We should all be securing lawyers for the whiplash regarding tariffs this week.

I’m sorry to those of you who look forward to Friday Potpourri for the amusement and the snark. I look forward to writing it. But there are things about which you need to be informed regarding what is going on with the tariffs, and how this impacts you and your family.

Are there still tariffs?

Yes. Thank you, Axios.

These tariffs are inflationary, will decimate many small US businesses and Chinese businesses, and are likely not going away any time soon. In addition, the reciprocal tariffs ON US exports will be incredibly painful to some sectors of the US, especially farming. But that’s not the big problem for today.

Why did the reciprocal tariffs REALLY get rescinded?

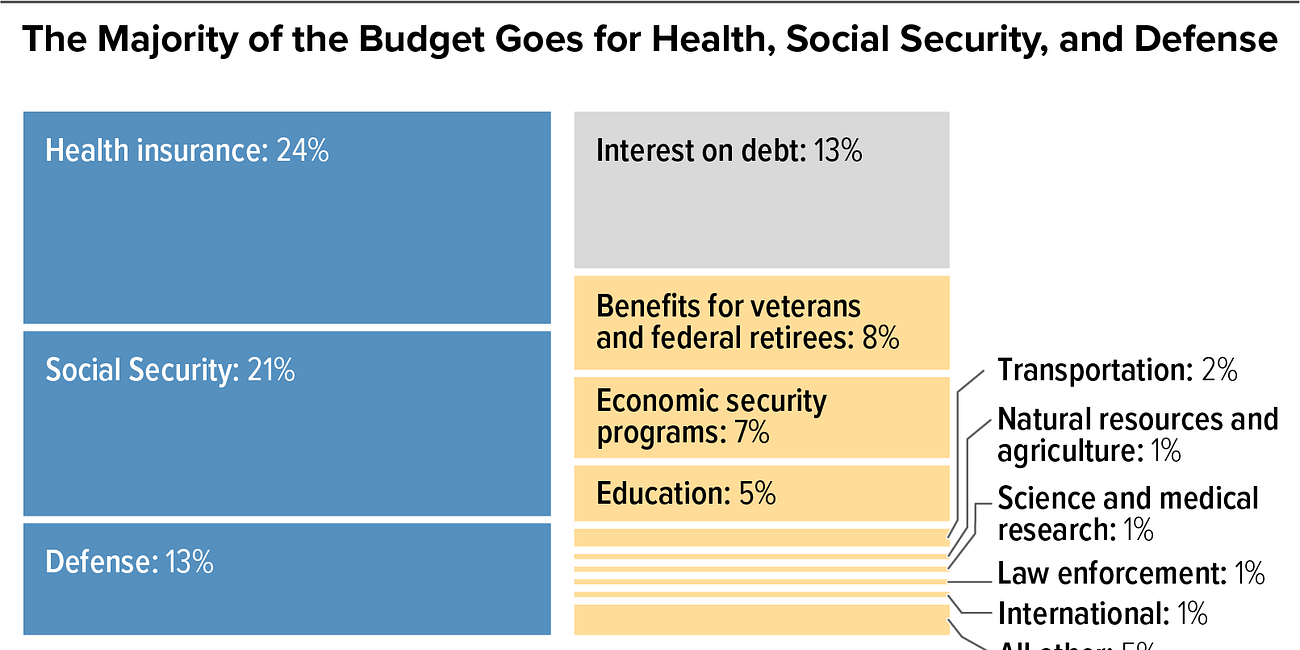

In a word, bonds. We’ve talked before about what the government spends on. Notice that grey box on the upper right: Interest on debt: 13%.

That “debt” relates to the bonds that the Treasury sells to raise money to run the government, and the interest paid to the bondholders. The US government has never missed an interest payment since the first bonds were issued in the late 1700’s. We’re SO solid, the the dollar is the world’s reserve currency, and is the most widely-used currency for international trade. More info. Complete information on Treasury bonds, in more detail than you will ever want to know is here. I only put in the link for completeness, I don’t advise reading it.

If we defaulted on our bonds, it would be BAD. (It’s why we raise the debt ceiling, although we could raise it far less if we took away tax cuts for billionaires. Sorry, I digress.)

If people (read: other countries and hedge fund managers) wouldn’t buy our bonds, that would be bad, also, as the government would have to hike rates until they found buyers. That is, if a bond pays 1% and no one buys it, there might be more buyers if it paid 3%, but likely there would be buyers if it paid 20%. The higher the interest rate paid, the more floating a bond costs the issuer. If, indeed, anyone would buy the bonds at any price.

Another thing that would be bad is if a lot of people (read: other countries and hedge fund managers) sold off the bonds they already owned. This is what happened overnight Tuesday into Wednesday. And it’s the bond sell-off, NOT the equity markets tanking, nor the “we want to negotiate” offers (if indeed that’s true), that caused the Convicted Felon to back off on tariffs. Information on who (and which countries) hold bonds (especially look at the charts involving China and Japan) is here.

Is it over?

Sorry.

Bond sell-offs mean rates go up for borrowers like companies and the US government AND the world is less eager to buy US bonds. If the world doesn't buy our US bonds that means our government cannot keep borrowing to pay its debts.

You may remember Liz Truss, who tanked the British bond market, and ended up being the shortest-serving Prime Minister in British history. The question in the papers was which would last longer: her tenure or a head of lettuce. In case you forgot.

The Orange Genius put us on a path to a complete worldwide financial system meltdown, culminating in the bond-selling frenzy. For now, things are still dicey, but somewhat stabilized.

What Happens Next?

Your guess is as good as mine. Because every scenario is prefaced with the word “If”.

Markets, investors, countries, companies, oh hell, EVERYBODY hates uncertainty. And any projections are completely dependent on IF Von Shitzenpants will do them or not.

Are their countries who will negotiate tariff rates with an end to a free-trade deal? Probably, BUT, the Orange Menace doesn’t care about rates, he cares about a trade deficit, and we just plain buy more than other countries. So, this is good IF the math works for him, and that’s a big fat maybe.

How will the game of chicken work out with China? Will someone blink? Tariffs above 100% are akin to an embargo, because it’s highly unlikely that prices, by either country, are absorbable by consumers. Remember that China makes certain medical products and devices that no one else does, and has some rare minerals that are hard to source elsewhere. Will those imports be affordable to us? Especially the medical supplies and medications? Will China refuse to export them? Can India ramp up quickly enough to make the meds we need? Big questions, especially since the Evil Genius is still threatening pharma tariffs.

And also on China - how does this impact the TikTok sale? The Chinese government has to approve it, too. Will they continue to sell off the US bonds they own because they believe the yuan can replace the dollar as the world’s reserve currency? Is that even a possibility?

And what of regular people, and legitimately small businesses as all of this plays out?

I don’t have a good answer, but it will pay to be eagle-eyed where bonds are concerned. Equities will eventually come back (the Wednesday rally didn’t make anyone whole, and Thursday sucked)…but eventually. But bonds? That’s what matters and my guess is that enough pressure will be brought to bear on Dementia Don that he’ll eventually give up and play nice. Someone should tell him that in isolating the country, he’s repeating the mistake of Brexit, from which Britain has never recovered.

,

Have you ever read “The Mandibles-a Family”? It was written before Trump 1.0 but describes a future starting in 2029 when an American President declares a “reset” on debt and defaults on Treasuries. Triggering a cancellation of the US $ as the world reserve currency and the economic doom that flows from that decision. Runaway inflation… sure, but that’s hardly the worst of it. Economic isolation-no assets are safe. A weakening dollar and a flight from US Treasuries is about as red a flag as you could find.

Who ever thought Government Bonds would be a bad idea?!? This whole thing simply boggles the mind. Another thing that boggles the mind is almost $900 BILLION paid in INTEREST in 2024! Thank you, fiscal conservative Republicans!

I don't think China is going to blink, this time. Diaper Don is way over his head this time around and totally lacks the bargaining chips - or skill - to accomplish anything. They are just not going to be bullied by a demented old man who shits his pants.

In the meantime, China is moving in where USAID has moved out, exerting even more influence throughout the world. The Felonious Fuckwad has overplayed his hand.