It’s hard to know where to start talking about how bad an idea this is. But politically, especially in Nevada, it’s a winning political idea. It SOUNDS so very good.

The minimum wage in the US is $7.25/hour, which was set 15 years ago. Meanwhile, for actually tipped employees, the wage is $2.13/hour. If you worked 40 hours a week for minimum wage, that would be $15,080 (assuming no holidays or vacations.) That’s awful, but for tipped workers, it would be $4,430, (without tips) which is way below the poverty level.

Right now, everyone gets a standard deduction off their gross income when they file their taxes. Therefore, a single person doesn’t pay any taxes on gross income up to $13,850, a married couple is exempt from taxes on the first $27,000, and heads of households don’t pay on the first $20,800. (That’s from the 2023 1040 form, rates will be higher this year, thus excluding more income.)

Therefore, the vast majority of tipped workers making $2.13/hour aren’t paying income taxes anyway. They are, and would under a “no taxes on tips” policy, still need to pay payroll taxes for Social Security and Medicare. That’s a good thing because we want them to get benefits when they retire, and if you don’t contribute you don’t make your quarters, and you don’t qualify.

The Republican plan for “no tax on tips” is not concerned with working people making $2.13/hour plus tips – they want people like Hedge Fund Managers to be able to shelter their massive incomes by calling them tips. I am not making this up.

Even under the Harris plan which rumor has it would cap the amount of tip income free from taxes, this is inherently unfair to people at the low end of the income scale. Let’s take two hypothetical single people. John Doe is a waiter making $2.13/hour plus tips. And let’s assume that he earns a gross of $35,000 for the year. Jane Smith works at a retail shop in the mall, and she also earns $35,000 for the year. Both would end up with a net income of $21,150. John would owe taxes on $4,430 (the $2.13/hour before tips) at a rate of 10% for total taxes of $443. Meanwhile, Jane would owe $2,318. (10% on the first $11,000 of income above the deduction and 12% on the remaining $10,150.) To repeat, it’s inherently unfair.

Then, thinking things through – it may well impact the amount of money people pay in tips, knowing that it’s not going to be taxed. Many people are already overwhelmed with the sheer number of locations that are “requesting” tips.1

In addition, I don’t know how this works at restaurants, especially non-chain restaurants. Several of the places that we procure take-out from have instituted a 3% charge unless you pay cash. So we pay cash, and tip, because I started waiting tables when I was 13 (at 65 cents an hour.) My husband never worked in the restaurant business, but he’s been married to me long enough to respect that WE TIP. If your server gets tipped in cash, and tips are not pooled – do they get reported?

My biggest objection, however, is that tipped workers (the ones that actually work for tips) don’t need a tax cut, they need to be paid better. The cost should be borne by the people who own the restaurants and their patrons, not the underpaid workers, nor the American taxpayers.

I think “no tax on tips” will be a thing through this election cycle, but I see no way that it actually gets implemented. It would have to get through Ways and Means in the House. If we retake the House, Ways and Means will be headed by Richie Neal (D-MA). If not, the committee will remain chaired by Jason Smith (Idiot R-MO). Both will easily win re-election. Either of them would need to offset the tax loss. For Smith, this would mean raising taxes elsewhere, likely by taking away the standard deduction, which hurts everyone and is part of both Project 2025 and Agenda 47. For Neal2 this would mean higher rates for rich people. Either way, there would need to be an offset for the taxes that would be taken from the pot. When it gets to the Senate, Ron Wyden (D-OR) and Mike Crapo (MAGA -ID) will be the Chair and Ranking Member of Finance since neither is up for re-election this year. Senator Wyden has already said that they’ll be looking for ways to raise taxes in 2025. While there will be a “menu” of possibilities, it will likely be on corporations and high earners. For Wyden, a tax cut is not in the offing. Crapo? He doesn’t actually believe in taxes, but it’s a Democratic committee, and we have a high probability of holding the Senate.

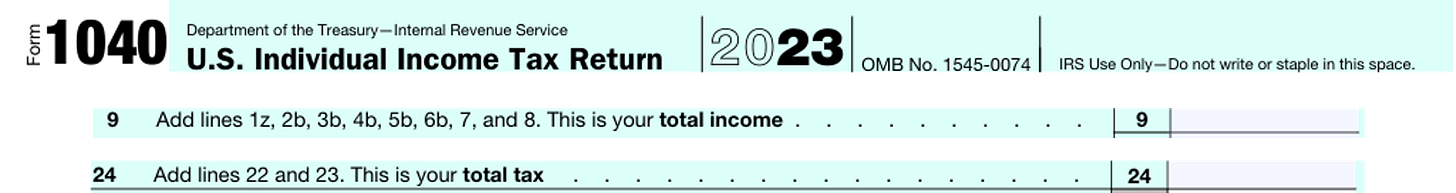

Finally, most people think they pay a lot more in Federal income taxes than they really do. To find out what your actual tax rate is, pull out your 1040 for 2023. Look at Line 9 and Line 24. Divide the amount on Line 9 by the amount of Line 24, and you’ll have your tax rate. Trust me, you’ll be surprised.

Personally, I am GLAD to pay taxes. I like things like schools, libraries, roads, Air Traffic Control, a military, and on and on. I like that our tax system is progressive, so that the more you make, the more you pay. This has become skewed since the 1950’s when the top tax rate was 90%, and corporations paid the lion’s share of taxes into the Federal coffers. I believe in what Henry Ford said about paying his workers well: he wanted them to earn enough to be able to afford his cars.

Corporations used to be okay with high taxes because it meant an educated work force, infrastructure and safety. Now, corporations pay 6% of Federal taxes, while individuals pay 42%. Source. Let’s take a hard look at the tax code, and make the rich and corporations pay their fair share, up the standard deduction to take the pressure off those who are struggling, and give up this silliness about not taxing tips.

I went to a place. It has a large area where you can buy cheeses, wine, charcuterie, and other goodies. You go to the shelf and pick up what you want. There is a separate section in the store where you walk up to the counter to get a pastry, coffee, a sandwich or a salad. Because I have no immune system, and wanted a type of cheese only they had, I went at 7 in the morning when they opened, was the sole customer, and selected my cheese out of the case. The regular registers weren’t open yet, so I went into the food counter area. I handed my package to the guy, he scanned it, and on the screen in front of me, I was asked if I wanted to tip 15%, 20%, 25% or any other amount. My question to the kid at the counter was whether he actually expected me to tip for something he scanned and handed back to me. He explained that’s how it’s done. I let him keep my cheese and I never went back. And because I later checked, starting salary for that position was $14/hour.

When he was Chair of Ways and Means, Richie Neal was the guy who fought with the IRS for Convicted Felon Trump’s taxes, and he's a hero.

I pay taxes on my full income, so should waitrons, bartenders, and everyone else.

It's no mystery that the 'no tax on tips' was brought up in Nevada. I worked for a casino at Tahoe in the '70s. Two of my roommates were dealers Michael made upwards of $200/day in tips. (All dealer tips were pooled and they all received the same percentage based on hours worked.) I was either a cook or management, so I didn't share in the tips, but another roommate who was a waitress easily made $100+/day in tips - and hers were paid out in cash every day. Casino workers especially don't want to pay taxes on that if they don't have to.

Granted, they're the exception to high tips - that single mom waitress at IHOP isn't making anywhere near that - and the $2.13/hr minimum wage for tipped employees is an insult. Any employer paying the minimum wage is telling their staff that they would pay them less if they could, but legally can't.

Interestingly, Zuni Cafe in San Francisco eliminated tips completely and raised their starting wage to $24/hr. Many of their staff quit because it was less than half what they were previously making - and $24/hr is definitely not a "living wage" in San Francisco.

On the nose.