“Taxes are the price we pay for a civilized society.”

U.S. Supreme Court Justice Oliver Wendell Holmes

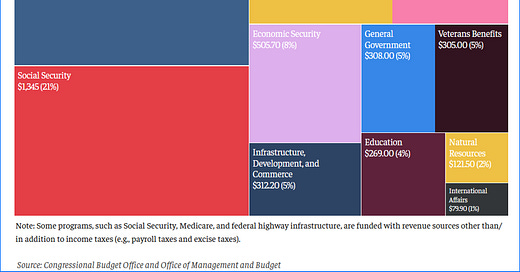

A lot of people, potentially most people, are prejudiced against paying taxes. They seem to HATE taxes. Generally, their vitriol is aimed at Income Taxes, so let’s look at them. I personally don’t understand this. I like paying taxes. I am glad to pay taxes. Taxes are a good payment for things that I really want, and would hate to live without. Below is an infographic showing where Federal tax money goes.

As part of this, some money is transferred back to the states. The chart below shows how Pennsylvania spends its tax dollars, including revenue raised by the state plus Federal transfers. Use this link to look at your state. Comparisons of the states are interesting, I promise you.

Let’s think about this for a minute. I don’t want to cut things – I SUPPORT everything in those charts. I’m sorry we have to pay interest on the debt, but that dates back to Alexander Hamilton, and it’s unlikely to ever go away. But I LIKE Social Security, Medicare, Medicaid, SNAP, Veterans’ Benefits, Education, Housing, Roads… the list goes on. I even like supporting the military – even as a pacifist, I recognize the importance of having a national defense.

If you are one of the people opposed to taxes, PLEASE let me know what you want to cut. But just in general:

The Republican Party used to believe in taxes. In fact, the highest taxes in history from when income taxes were enacted, were in the 1950’s under a Republican administration. Also at the time, were the highest corporate tax rates, and in terms of real dollars, a far greater percentage of government coffers came from corporations than individuals. See below:

This all changed with Alzheimer’s-afflicted Ron Reagan and his crew of miscreants. They convinced the minions that taxes were bad, bad, bad, all while increasing government debt. Not joking. They caused huge deficits by cutting taxes. Let’s look at the past several administrations. Clinton inherited a deficit, left with a surplus. Bush started with a surplus, and created debt. Obama took on Bush’s debt, and cut it by more than half. The Convicted Felon created more debt than anyone else, actually increasing the total national debt by 30%. Source. We won’t know Biden’s numbers until next year.

There is such cognitive dissonance about taxes. When local candidates canvass, there are voters who ask if they will promise to not raise taxes. I always tell them to say: “I live in the community here, just like you do. And I’d love it if MY taxes didn’t go up, so I’ll make you a deal. You find a way to make sure that the cost of fuel in the cars for the police and the trucks for the fire department doesn’t go up. That no teacher, or any other public servant can get a raise. That the costs for necessary supplies, like electricity for our schools, libraries and public buildings and everything else they need, are kept at current rates by the vendors. That local roads don’t need repairs, and that bulbs in the streetlights never need to be changed. Do all that, and I’ll promise not to raise your taxes.” Voters who hear this are often gobsmacked, because they never relate “services” to “payments for services”.

To be honest, there are several countries without any income taxes. Like Somalia, otherwise known as a failed state. Like Vatican City, which is funded by the Catholic Church (don’t get me started). Plus the really rich Arab states that live off of oil money. And a few more. But the vast majority of countries need taxes to pay for services, and PEOPLE NEED SERVICES!

The idiot Convicted Felon and his minions want to cut taxes. “No taxes on tips”, “No taxes on overtime”, “No taxes on Social Security”, “No corporate taxes” – OK, they never said “no corporate taxes” but that is something they’d like. Face it – they are opposed to taxes for two reasons: first, they want to starve government so that it cannot operate at all, and second, they want to deny benefits to anyone who isn’t seriously rich.

I’ve already written about why “No taxes on tips” is such a bad idea. I could write a corollary on overtime, but just read the first piece, and you’ll see the logic. But I do want to touch on the idea of Social Security taxes. Right now, the poor don’t pay any taxes on Social Security benefits, and the upset limit on who doesn’t pay should have been indexed to inflation years ago. But there is an inherent unfairness in saying that those that can afford the taxes shouldn’t pay them. All of us who work pay into Social Security (except some exempt people). But the vast majority of Social Security recipients receive more in benefits than they paid in. (Honest, go to https://www.ssa.gov/ and look at your work history and you’ll see what you paid in, and then you can see in your statement how much you get/will get in benefits, multiply by years received and you’ll see I’m correct, unless you die young.) That “excess money” can be considered a benefit of the investment of what you put in. And we all pay taxes on the benefits of our investments, like interest, dividends, capital gains, etc.

We ALL benefit from taxes on a regular basis. Do you have a mortgage? The cost is decreased because you can deduct the interest. (If you live in a high-tax state, yes, you were screwed by the SALT cut under the Convicted Felon’s tax “cuts”.) Lost a job? Taxes make sure you get unemployment insurance. Health insurance on the open market? Taxes help pay your ACA premiums. The list goes on and on.

The issue with taxes is FAIRNESS. I lost my job in 2009, and didn’t work a real job for 16 months. I paid very little in taxes. My only income was from unemployment insurance, and some occasional pick-up work. For example, I once found a gig on Craig’s list that paid me $100 for testing printers. Because of thank-you-President-Obama, my COBRA payments were underwritten with tax dollars. Don’t get me wrong, it was rough, but I benefited from the taxes paid by others. I work a regular job now, and pay a lot more taxes than when I was unemployed. We have a progressive tax system (albeit not progressive enough) and that’s as it should be. We should all pay less if we make $10,000/year, more if we make $50,000/year and a LOT more if we make $500,000/year.

The choice in November is simple: the rich pay more, the corporations pay more, and those less fortunate pay less OR the rich pay less and everyone else suffers. The MAGA idiots believe their Fearless Leader when he says that China and other countries will pay the tariffs, and that will make up for tax cuts. For the umpteenth time CONSUMERS PAY TARIFFS TO VENDORS, NO MONEY GOES TO THE US TAX COFFERS.

One idea of the idiot Rethuglicans is the equivalent of VAT, or Value-Added Taxes. From a consumer perspective, they work like tariffs in that we all pay more for everything, but in this case, it is a tax. More honestly, it is a set of taxes.

A manufacturer buys raw materials, and pays a VAT tax to the supplier. The manufacturer uses those raw materials to make something, and sells it to a distributor who pays a VAT tax to the manufacturer. The retailer buys the thing from the distributor, and pays a VAT tax. Finally, when you buy that thing, YOU pay a VAT tax. At each stage, the VAT pays for the previous transaction, and YOU carry the burden. Like this:

This is a regressive tax because it hurts the poor much more than anyone else. VAT taxes would be assessed on EVERYTHING, including things that everyone needs every day: diapers, toilet paper, milk, eggs, bread, you get the idea. Some proposals also include VAT taxes on services, you know, like seeing the doctor.

So when you talk to voters, and they complain about prices, look forward not back and ask them if they want to give up income taxes, and instead pay a tax on every last thing they consume. Believe me, it will cost more unless you are a member of the 1%.

Most people do not know what they pay in income taxes, and therefore cannot compare it to what VAT would cost them. This post is long already but if anyone wants the math, leave a note in the comments and I’ll show you how to do the calculations.

You’ve explained the need for taxes so well. Always my argument… I don’t have children, and yet I will gladly pay taxes to have an Educated populace! Love the graphics…so very helpful!

Ah, yes... thank you, Redistribute Ronnie for taxing my Social Security check hailing your trickle-down fiasco. He was a lousy actor, too.

The liars of the Right did a great job of portraying Government Waste and corruption - The Welfare Queen immediately come to mind - while hiding the fact that the *real* welfare queens are their corporate cronies and billionaire benefactors. Sadly, the Democrats have never been very good at exposing or refuting this.

People also blame the IRS for tax problems - not understanding the the IRS doesn't write the Tax Code - Congress does - and they merely apply the rules Congress creates - the reason Irresponsible Republicans underfund them. Less people and funds means less ability to go after the big cheats - the aforementioned corporate cronies and billionaire benefactors who claim their billion dollar yachts as a business expense - while nailing the little guy who claimed his cold water flat as a home office.

It is all about fairness - and our current Tax Code is very unfair.