Yes, the Orange Menace has a lot to take credit for, with even more disastrous economic news to come.

The big question for me is whether we’ll see a standard recession, or if the policies are so incredible that we’ll end up with stagflation.

There’s an old adage that a downturn is when you read in the paper that there are negative economic headwinds, a recession is when you know someone who has lost a job, and a depression is when you lose your job.

We all know recession. The amusing part is that it’s backward-looking. That is, a recession is not formally declared until after two consecutive quarters of a decline in economic activity, job losses, and lower wages. There are other related definitions, but the point is that you feel it before the powers that be admit it’s here.

One of the economic indicators that comes before, and potentially helps lead to, recession is the inflation rate. There is something that gets missed in inflation calculations. It’s obvious to me, so I don’t know why it’s discounted by economists. When inflation is calculated, they look at the prices of THINGS. So when the costs of eggs, gasoline, clothing, etc. rise, that’s inflation. But THINGS are not the only thing that most people pay for on a monthly basis. People also pay interest, which is never part of the calculation, and it’s that rise in interest rates that can push people into disaster. For example, if your credit card rate goes from 18% to 22%, that’s additional money you have to pay every month on things you probably bought a long time ago. Same with an adjustable-rate mortgage. This lack of inclusion of interest costs in inflation calculation is one of the reasons that people feel so badly about the economy, even with the economists saying “Look! Inflation is going down”. Factually, inflation rates would be higher if interest rates were included.

We all know what recession looks like. Unemployment goes up, inflation goes down slightly, house and equity values erode, financial markets are in turmoil, and businesses close and lay off workers, adding to the unemployment rate. When the unemployment rate is high, wages go down, both related to new hires and raises for existing employees. The only upside is that interest rates normally decline.

Recessions are considered a normal part of the overall economic cycle: some are short and mild, some are worse, but in modern times, they normally last a year or less. They used to last longer. Full list of US recessions is here.

WHEN the next recession will hit is a function of two things: first, how quickly all the new plans are implemented. The Federal layoffs will add to the unemployment rate if those folks can’t find new jobs quickly. Massive tariffs that all hit at once, and hold, will make the recession occur sooner. Second, the PERCEPTION people have about the economy. If people are convinced that inflation will rise, they will buy now (if they can) to prevent having to pay higher prices later. If businesses believe that there will be a slowdown, they will pause investments in new/expanded facilities and slow hiring.

If you agree that recession is coming, there are things you should do NOW. Different people will approach this based on their current situation, and this is general advice, it doesn’t replace any personalized advice you can receive from a financial advisor. If you are of limited financial means, a pro bono financial planner may be available to you. Click here for more info.

Reduce debt, and avoid taking on new debt.

Put money into savings. The standard rule of thumb is that it pays to have an Emergency Fund with 3 - 6 months of living expenses in it. The statistic is that 37% of Americans cannot pay out of pocket for a $400 emergency, so funding for months is a reach. But START - even if that means finding $1/week to put in a jar.

Review your spending. Look for expenses to cut. Cut them.

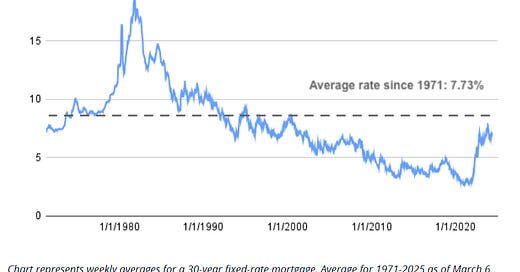

And now, let’s consider stagflation, which looks to me like a possibility. People my age remember the stagflation in the late 70’s and early 80’s. It is a recession on steroids. You get the high unemployment, high inflation, low economic growth, but you also get, wait for it, high interest rates. How bad?

You can also check the Misery Index, which reached its highest level, so far, in 1980.

Stagflation is RARE and can only occur if there is a huge shock to the overall economic system. The last time, the precipitating factor was the huge rise in oil prices that started in the early 1970’s. My gut says that if anyone can cause this, it’s Von Shitzenpants.

Prepare for stagflation the same way you prepare for recession with one added factor: make yourself as marketable as possible. You may need to change careers. So, hone your skills now. If possible, get cross-trained where you work. Make sure your resume is up-to-date and that you’re ready to personalize it for different opportunities.

It pains me to write this paragraph. Like everything else in our current corporatist society, if you have money, you have opportunities during stagflation. Because of high interest rates, what you earn on savings, money markets, I Bonds and TIPS will yield decent returns. In addition, while one should NEVER time the market, there will be good buying opportunities available. It’s sad because it seems that no matter what, rich people do better, and get richer, even when everyone else suffers.

Can this horror show be avoided? W-e-l-l-l-l if there were a sane person in the White House, and a set of economic advisors who cared about the health and strength of both the American and world economies, SURE. But that’s not the situation we have. We have people who WANT to destroy the world economy. So please, protect yourself as well as you can.

Great summary. Thank you!!

I, for one, feel for my kids, grandkids, and all Americans in the 90%. Perhaps. in time, sanity will prevail when buyer's remorse sets in.